In 2015, the Governor of the Bank of England issued a stark warning that both the direct impacts of climate change and those of climate policies could have pronounced effects on the UK’s financial and insurance industries. FRANTIC will address the so-called transition risks of climate change resulting from the economic impacts of a rapid transition to a sustainable energy system. These risks include the loss of value or ‘stranding’ of fossil fuels and related infrastructure as well as the resulting effects of financial shocks triggered by climate policy and technological change. FRANTIC will develop new models of the macroeconomy and financial networks to assess the risks and consequences for the UK economy, and will build an associated network of policymakers, researchers and stakeholders in the financial sector. The role of the network will be to identify policy approaches and strategies that could strengthen the resilience of the UK economy to climate-related financial shocks.

This project aims to develop a robust characterisation, quantification and communication of climate-related transition risks, thus addressing a key objective of the UK Climate Resilience programme. To achieve this, we will improve and apply a set of software tools and a consultative analytical procedure to assess the risks to the UK’s financial and economic stability of a rapid transition to a low-carbon economy, and its impact on the real economy, jobs and income. Focusing on the largest privately and state-owned companies and covering most of the global value at risk, we will gather data on the distributions of both their physical fossil-fuel assets and the main investors in their financial assets, thus mapping the principal linkages between fossil-fuel assets and financial actors. Using this map, together with our modelling toolkit, we will explore the vulnerability and resilience of the UK’s economy and financial sector, and investigate the magnitude and distribution of potential impacts.

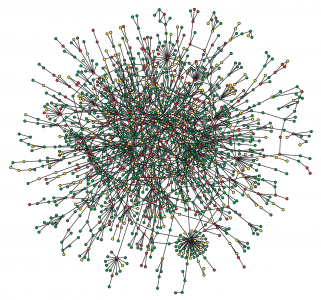

Image: A scale-free network from Barabasi and Bonabeau, Scientific American 288(5) 60-69, analogous to the global financial system, illustrating the complex pathways by which climate-change related economic shocks might propagate to pension funds and other essential elements of the financial system.

Project outputs

- Mercure, JF. 2019. Toward risk-opportunity assessment in climate-friendly finance. One Earth. 1, pp. 395-398.

- , , , , . 2021. Low-carbon transition risks for finance. WIREs Clim Change. 12:e678.